Private equity offers a unique opportunity to diversify your investment portfolio beyond traditional stocks and bonds. By investing in private companies or funds, you can access a broader range of opportunities that may provide higher returns and reduced correlation to public markets.

What is Private Equity?

What do Amazon, Apple, Facebook, Tesla, and Microsoft all have in common?

They all started as private companies, typically with a small group of initial investors (often called angel investors). If you went back in time, wouldn’t you invest in these companies from the very beginning?

“Private Equity” is a general term for investing in privately held companies or funds that support them. Also known as “Private Markets,” this alternative asset class is not available on public exchanges. It focuses on long-term value creation through strategic management and operational improvements, allowing investors to engage with innovative companies before they gain mainstream recognition.

Types of Private Equity

We mentioned “start-up” examples, but a whole universe of private market investments exists. They range from start-ups to mature businesses, including real estate, infrastructure, and private lending. These opportunities, which are not typically available to the general investing public, offer an exclusive chance to diversify your investment portfolio.

Infrastructure

Energy transition, digitalization, enhancement of aging infrastructure.

Real Estate

Commercial real-estate across multiple sectors.

Venture / Growth

Early stage, fast growing companies.

Private Credit

Debt investments outside of the public markets.

Buyout

Mature businesses with positive cash flow.

What Are Private Equity Firms?

There are several ways to invest in private equity, with one common method being through a private equity firm. These firms gather capital from multiple investors to create a private equity fund that invests in a diversified portfolio of private companies, following a specific investment strategy. Experienced professionals manage these funds, identify investment opportunities, execute strategic investments, and oversee the portfolio companies to help maximize returns.

The Benefits of Private Equity FIRMS:

Diversification

Spread risk across multiple investments.

Professional Management

Gain access to experienced fund managers.

Scalable Opportunities

Invest in companies at various stages of development.

Pros and Cons Of Investing in Private Equity

Institutional investors, such as hedge funds, mutual funds, endowments, and wealthy individuals, are often attracted to private equity investments. Their capital provides funding for early-stage ventures and plays a significant economic role. Whether you’re an accredited investor or new to alternative investments, a fiduciary financial advisor can help you weigh the pros and cons.

Positives:

Diversification

Private equity assets are less influenced by daily market swings.

Broaden Exposure

Access to exclusive opportunities unavailable in public markets and invest in sectors or companies driving innovation.

History of Outperformance

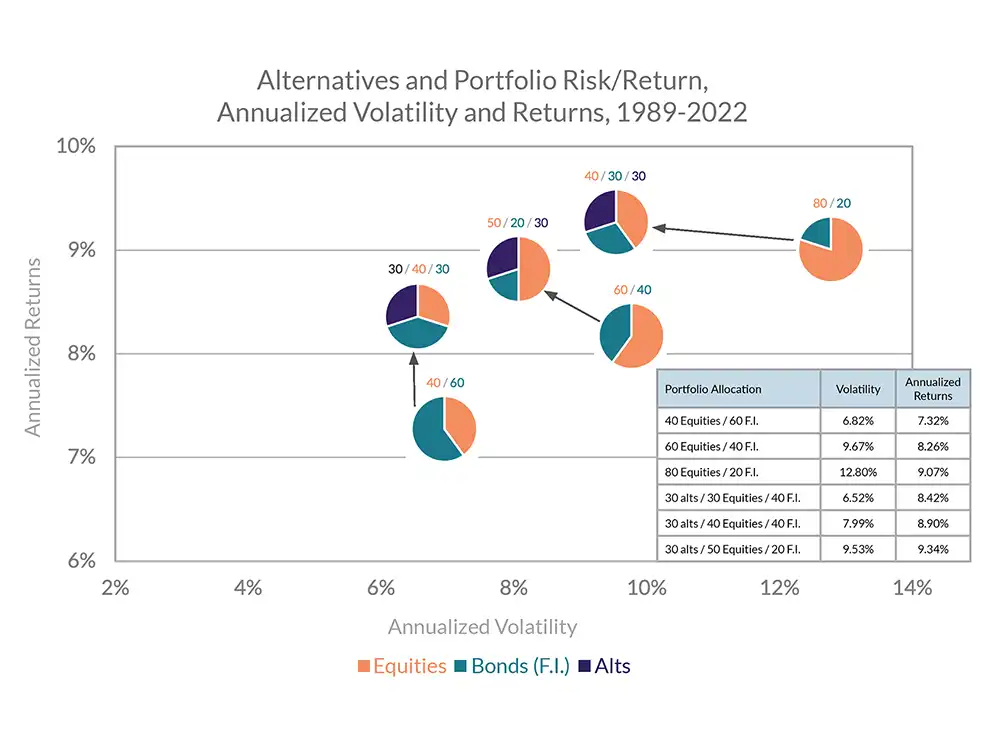

Private equity has historically outperformed stocks with lower volatility, offering extra returns due to its illiquidity. Adding private equity to a traditional stock and bond portfolio can boost returns and reduce risk, as shown in the chart below.

Source: Bloomberg, Burgiss, HFRI, NCREIF, Standard & Poors, Factset, JP Morgan Asset Management. Allocations to alternatives benefit both the return and risk profile in investors’ portfolios across multiple decades. Past performance is not indicative of future performance. Your results may vary.

Downsides:

A Long-Term Investment Horizon

Private equity investors typically need to allow for a 5 to 12 year investment horizon.

Hands Off Approach

Investors, known as "limited partners," delegate control to the private equity firm that manages the fund, referred to as the "General Partner." They do not participate in investment decisions.

Limited Access

Not everyone can invest in private equity. Investors need to meet asset requirements to show they have sufficient liquidity to meet initial investment and capital calls.

How to Get Started With Private Equity

Navigating the world of private equity requires expertise and a clear strategy. Our fiduciary advisors can help you:

- Assess your risk tolerance and financial goals.

- Identify private equity opportunities aligned with your needs.

- Build a diversified portfolio that incorporates this dynamic asset class.

Trajan Wealth’s private equity offerings are intentionally boutique. Our private equity opportunities have been selected with hands-on due diligence and strategic expertise. We also have lower minimum investments than larger firms, meaning less risk. Lastly, we negotiate private equity fund management fees, which can mean more returns for investors.

Let’s Talk About Your Investment Goals

Private equity can be a powerful tool for achieving your financial objectives. Receive guidance from a fiduciary advisor who will put your best interests first. We do the homework – especially when finding opportunities for sophisticated investors seeking unique opportunities outside public markets.

Contact us to schedule a complimentary consultation and learn how private equity can work for you.

*Investment in private equity may require accreditation.*