Unlock income for life

For a limited time

An annuity is the only available product that will guarantee income for your entire life. Your future income will grow tax-deferred with an annuity, unlike CDs and savings accounts. Most Trajan Wealth annuities come with fees of 1% or less per year. Plus, you can qualify for up to a 30% bonus just for opening an account, which can be used for income purposes.

Hypothetical Example:

Commit $200,000

+ 30% bonus upfront

+ up to 12% growth over ten years

= $450,000

(For income purposes)

CONTACT US TODAY

Learn more about our annuity offers

Information is secure and never shared with unaffiliated parties. By clicking submit, you are opting in for Trajan Wealth to contact you by phone, email, and text. Please note phone calls are recorded for quality assurance. Standard text message and data rates may apply. You can opt out of text messages by responding STOP at any time. Please view our Privacy Policy for more details.

Do you...

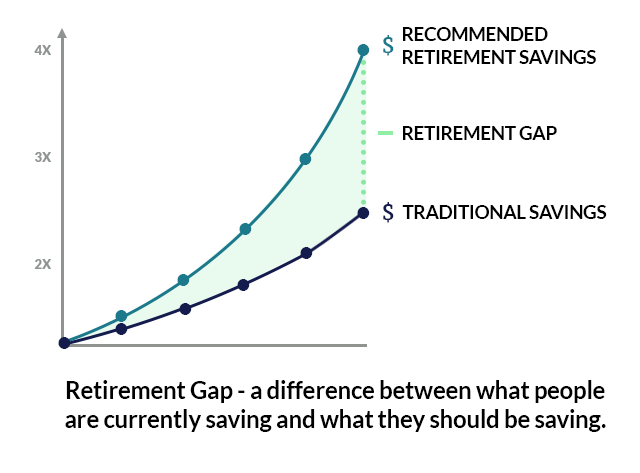

Have money earning next to nothing in the bank?

An annuity might be right for you

CALL US AT

We Specialize In Custom Financial Plans

No two portfolios (or retirement plans) are alike and that’s what makes working with us so different from anywhere else. We offer guidance based on your individual needs whether it be to generate higher returns, to provide you with guaranteed monthly income, or if taxes concern you as well.

Our advisors have years of experience and knowledge which means they can give you objective advice about your investments. One thing we don’t recommend? Trying to time the market! It’s nearly impossible for people to predict where the market will bottom until after it has already happened. We’ll instead help you stay focused on your goals in the long term by creating a portfolio with tactical changes today, while also giving thought to how these changes may affect you tomorrow.

HELPING YOU WEIGH YOUR OPTIONS

About Us

Founded in 2012, Trajan Wealth is an independent financial services company with thousands of clients that we’ve helped.

Jeff Junior, the CEO, is a Marine Corp veteran. Our team shares common values like committing to solving others’ problems.

Despite our decades of experience, our full service team actually starts with you. We consider our clients to be a part of the team.

A STRESS-FREE PROCESS TO PROTECT YOUR MONEY

We'll do the paperwork and guide you step by step

First Step

Schedule a short call with a fiduciary advisor. We will answer any questions you have, review your goals, and give you guidance on what may be the best options for you.

Second Step

In our follow-up meeting, we enter a detailed fact-finding process. This includes learning more about your specific financial situation so we can tailor a custom solution.

Third Step

Our team will review your current retirement strategy and level of market risk. Then we present you with customized options designed to protect and grow your investments.

GET INFORMATION WITH NO OBLIGATION

As Seen and Heard On