What is a Fiduciary?

A fiduciary is a professional who is obligated to act in your best financial interest. Whether you’re planning for retirement, managing investments, or seeking estate advice, fiduciaries offer guidance tailored to your goals and circumstances.

Professional financial advice can add up to

3%

to portfolio net returns over the long term.*

*Depending on the time period and how returns are calculated. Source: Vanguard, Putting a Value on Your Value: Quantifying Vanguard Advisor’s Alpha® updated August 2022.

What Is The Difference Between Fiduciaries And Other Financial Advisors?

When it comes to financial advisors, there are numerous types, as well as various certifications and licenses that they may hold.

Essentially, there are two groups: Fiduciaries and brokers.

Fiduciaries

Work for the client!

Brokers

Work for their firm.

Fiduciaries vs. Brokers: Key Differences

| Financial Fiduciary | Broker | |

|---|---|---|

| Obligation | Prioritize their clients’ interests over their own | Sells suitable financial products |

| Compensation | Fee-only or fee-based | Commission-based |

| Transparency | Full disclosure of fees and conflicts | May have hidden fees and/or conflicts of interest |

| Client Relationship | Long-term and personalized | Transaction-focused |

| Regulations | Governed by fiduciary standards | Governed by suitability rules |

It’s important to know that financial advisors can be dually registered, which means they can be both a fiduciary and a broker, switching between the two roles, depending on the situation. Trajan Wealth advisors are not dually registered.

Trajan Wealth Fiduciary Advisors are Committed to Prioritizing Our Clients’ Interests Over Our Own.

We Will Save You Time.

Do you have the time and energy to create an effective financial plan? Most people don’t. If you do decide to explore investment options and stay updated on market changes, consider this: What if your plan fails? Financial advisors spend their time researching investments so you don’t have to. That’s our job.

We Help Prevent Emotional Decisions.

Volatility in the market triggers our fight-or-flight instincts. Whether the markets are rising or falling, it can be hard to keep your emotions from overruling logic. One snap decision could cost you a lot of money—and possibly your retirement. A fiduciary advisor can help you from an objective and rational perspective. We have the experience and separation to consider your investments with a long-term perspective.

We Help Keep Your Investments On Track.

Consistently reviewing your portfolio allows you and your advisor to re-evaluate your investments and make sure you are on track to hit your retirement goals. Market conditions change over time, and if you don’t keep up, your portfolio may not stay aligned with your needs.

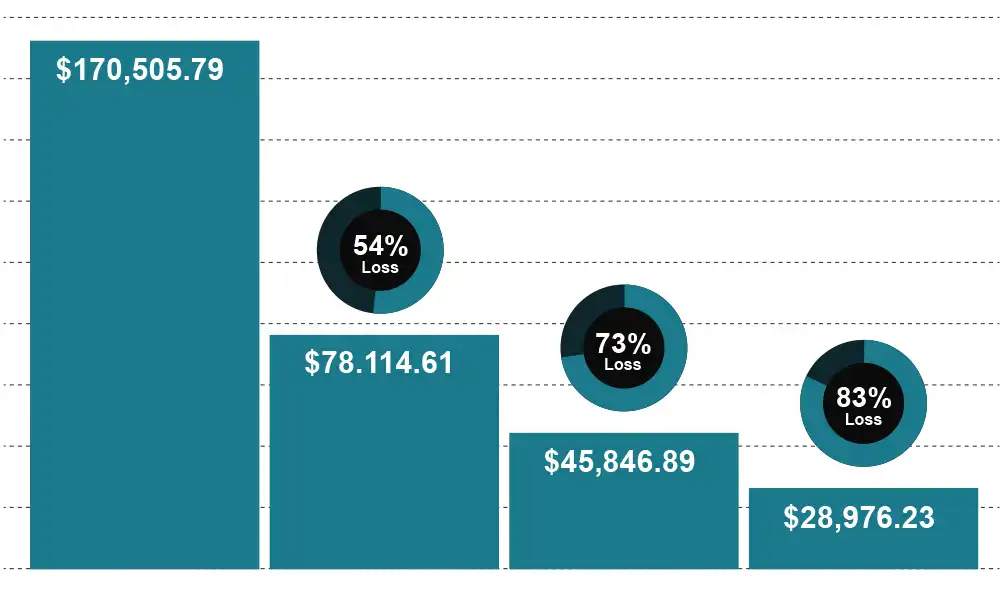

Investors without advisors can have less discipline in volatile markets, so they’re more likely to miss recovery days.

S&P 500 Index Average Annual Total Returns: 1992-2022

Source: Data from Trajan Analytics. Past performance does not guarantee future results. For illustrative purposes only.

Your portfolio’s risk level can change over time. If one asset class performs better than others, it can become “overweighted” compared to the rest.

The Original Portfolio

The Portfolio 10 Years Later

Hypothetical example for illustrative purposes.

FAQs

Yes, as a Fiduciary Advisor, we are obligated to always act in your best interest.

A fiduciary cannot act out of self-interest. If our advice carries any potential conflicts of interest, we’ll raise the issue with you. You can also read about our relationships in our CRS form and ADV forms.

Our fiduciary advisors are hand-picked for their extensive experience and ethics. Many also have designations, such as Certified Public Accountant, Certified Financial Planner®, Chartered Financial Consultant®, or Chartered Financial Analyst®.

Working with a Trajan advisor is easy. Schedule an initial meeting. We will answer any questions you have, reviewing your goals, and give you guidance on what the options are for your investments. In our follow-up meeting, we go through a detailed fact-finding process. This includes learning more about your specific financial situation so we can tailor a solution just for you. Our team will review your current retirement strategy and level of market risk. Then we present you with customized options designed to help protect and grow your investments. Once you become a client, you can contact us at any time to speak with a fiduciary advisor for questions and making changes.

All Trajan Wealth clients, regardless of investment level, receive annual reviews with a Portfolio Manager and can reach out to us with questions anytime. The frequency of the reviews increases as your portfolio grows. Read about our client benefits here.

In Summary, Trajan Wealth Can Help You…

Stress-free approach to protect and help grow your investments.

We take the time to understand your specific situation.

We specialize in rolling IRAs and 401(k)’s over.

We walk you through the process and even complete paperwork for you.

Our fiduciary advisors have low transparent fees.

Ready to Take Control of Your Finances?

If you have retirement savings from different employers or advisors, we can help you consolidate your assets and navigate the transfer process. Actively managing your finances allows for more investment options and better monitoring.

Clients Say…

Leah T.

Actual Trajan Client

“We love working with Trajan Wealth.”

We love working with Trajan Wealth. Our advisors explain things well and we’ve been pleased with the results. We highly recommend working with them!

Michael K.

Actual Trajan Client

“Always thorough explaining all investments.”

Always thorough explaining all investments.

Robin F.

Actual Trajan Client

“Trajan wealth has been fantastic for giving me the confidence to retire and have a plan for the future.”

Trajan wealth has been fantastic for giving me the confidence to retire and have a plan for the future. THANK YOU!!

Rowena H.

Actual Trajan Client

“A very professional group of people whose first priority is their clients.”

A very professional group of people whose first priority is their clients.

Actual clients, no compensation, no conflicts. Trajan Wealth Google Reviews.