Financial Wellness Metrics for Pre-Retirees

Almost ready to retire? Here are eight key financial wellness metrics that pre-retirees must monitor as they approach retirement.

A blog for everyday financial tips, Trajan news updates, and more

Almost ready to retire? Here are eight key financial wellness metrics that pre-retirees must monitor as they approach retirement.

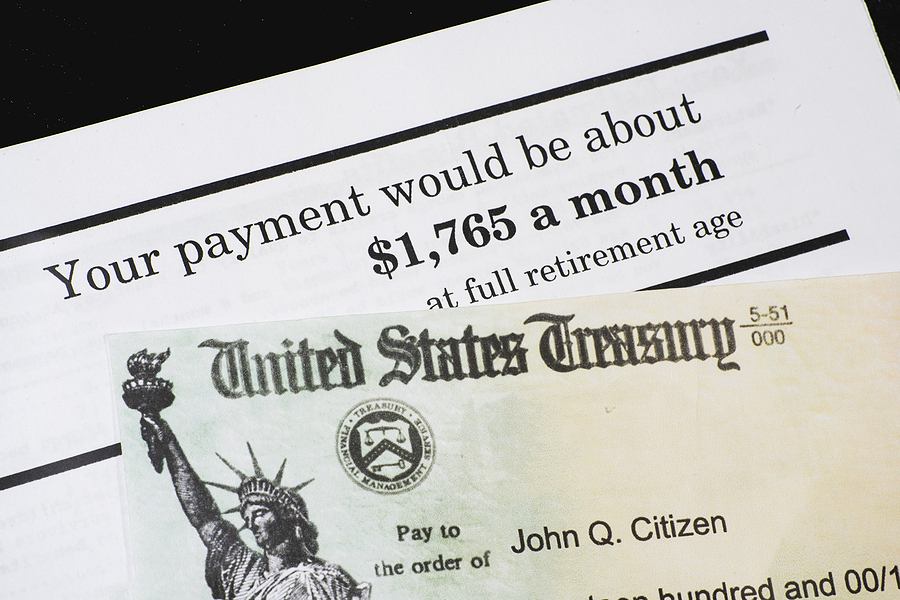

The Social Security Trust Fund needs more reserves due to a lower worker-to-beneficiary ratio caused by demographic changes. Congress needs to take action to prevent the trust fund reserves from being exhausted by 2035. Otherwise, a 24% reduction in benefits starting from 2024 is expected. Here are some of the changes forecasted.

Retirement is the time to kick back and enjoy the fruits of your labor. Here are 7 tax-effective strategies to help sweeten your fruit basket.

Tax-advantage strategies like Roth IRA conversions can save money on income taxes during retirement but, there are some penalties to note.

As 3rd quarter is wrapping up, it is time to refocus on your comprehensive financial review. Here is a checklist from Trajan Wealth to get started.

Small business owner? You should establish a retirement plan to help be more financially confident in retirement. It may also help attract and retain qualified employees and offer business tax savings.

High-earning women have become the newest face of wealth and will increase their net worth even more. Women have unique needs that often differ from their male counterparts. Taking action to manage their wealth and plan for their future can help women pursue financial confidence, regardless of their income.

For 2023, Social Security Retirement and Supplemental Security Income (SSI) benefits increased due to inflation. Social Security was meant to be one source of retirement income, with monthly retirement income from other strategies such as Traditional and Roth IRAs, Annuities, and Cash Value Life Insurance.

Having enough retirement income is a top concern for many Americans nearing or in retirement. Having enough retirement income for what you need and want is essential and must be planned for, even in the best economic conditions. A way to provide income safety is by using annuities as an asset class in your retirement portfolio. Here’s a brief overview of the different types of annuities that can provide an alternative for retirees seeking income and safety.

Helping your child save for retirement starts with financial education and discussing the importance of saving for their future. Besides financial education, there are strategies to help them get a head start on their retirement savings. Life Insurance, 529 plans, and Roth IRAs are all great options to discuss with your financial profesisonal.