Resilience, Innovation, and Opportunities

Innovation tailwinds are driving stock market valuations due to AI, and bond yields have reached their highest levels in decades. The future looks bright with numerous opportunities for investors.

A blog for everyday financial tips, Trajan news updates, and more

Innovation tailwinds are driving stock market valuations due to AI, and bond yields have reached their highest levels in decades. The future looks bright with numerous opportunities for investors.

The S&P 500 was up 8.7% in the second quarter and 19.4% over the past year. Despite fears of inflation, rising interest rates, and a weakening economy, investors are optimistic about future earnings growth. That’s especially true in the technology sector, where there have been rapid advances in artificial intelligence. We encourage investors to ignore the short term so they can focus on their long-term financial plan.

Getting your estate planning together in Tampa means spending time relaxing on the beach and soaking in the beautiful views. But before you take off your sandals and soak up

As the US economy remains in a late economic cycle for an extended period, it’s important to remember that the stock market is the story of cycles, and human behavior is responsible for overreactions in both directions. Despite the transition to a tightening monetary policy environment, the markets continued to improve overall in June. However, we still expect high market volatility going forward.

Investors may not fully understand how a strategy called asset location may help improve returns and lower their overall tax bill using these different types of accounts. Here, we outline what you need to know about each account type.

High-earning women have become the newest face of wealth and will increase their net worth even more. Women have unique needs that often differ from their male counterparts. Taking action to manage their wealth and plan for their future can help women pursue financial confidence, regardless of their income.

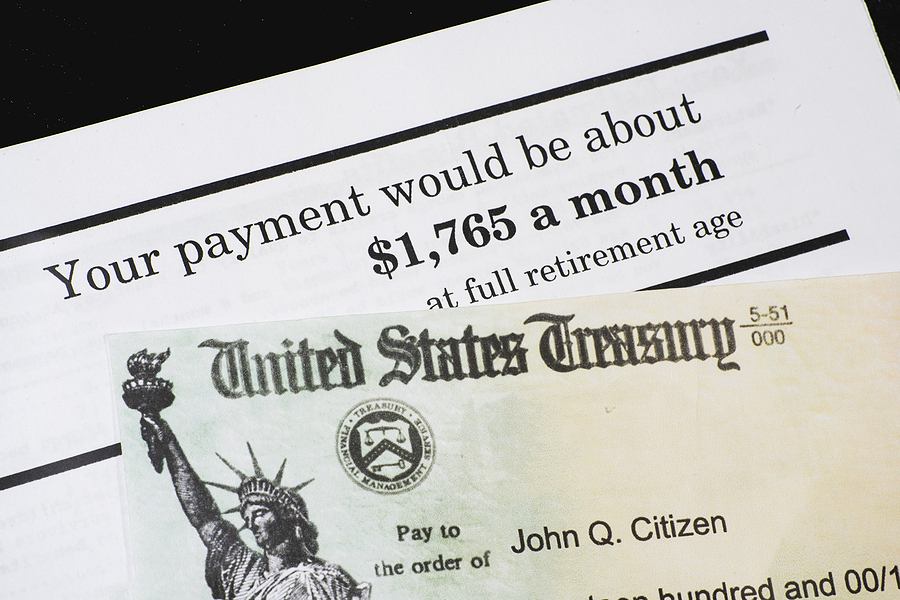

For 2023, Social Security Retirement and Supplemental Security Income (SSI) benefits increased due to inflation. Social Security was meant to be one source of retirement income, with monthly retirement income from other strategies such as Traditional and Roth IRAs, Annuities, and Cash Value Life Insurance.